About HighView Equity

As business owners and investors, we saw many companies in the following state:

+ Not growing quickly enough to attract publicly traded companies

+ EBITDA not large enough for national private equity firm exit

+ Desire for liquidity and no family succession plan

We saw an opportunity to facilitate a transition to the next generation.

HighView Equity partners with brokers and owners to source companies that, while not destined for an IPO, have created significant value in terms of intellectual property, technology, team, and brand recognition.

Specifically seeking owners who are interested in participating in an exit, want to see the company live on for many years to come and would like to see there staff taken care of.

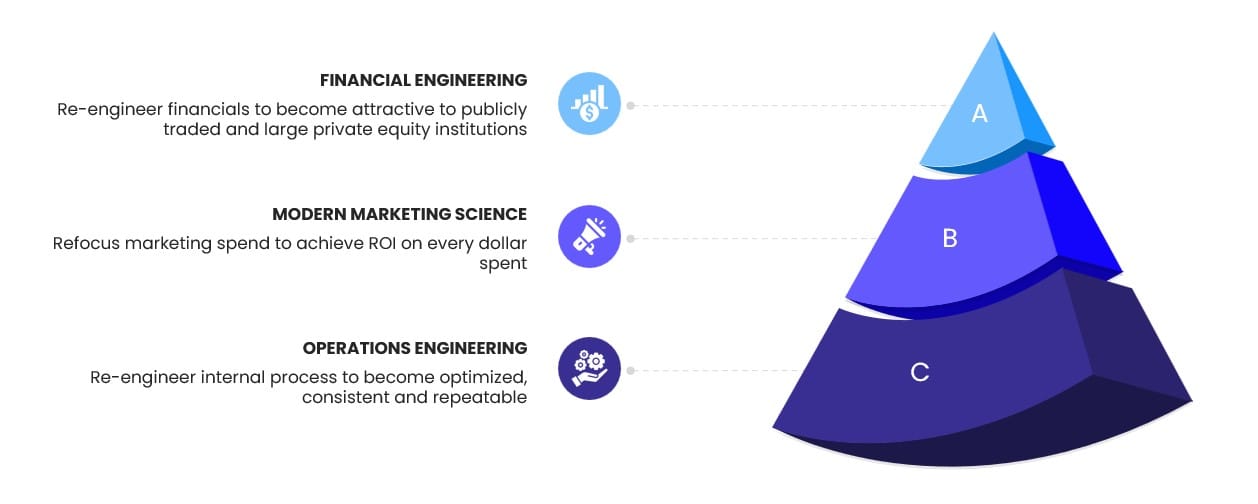

HighView Equity creates value by specializing in three key areas being;

1) Financial Engineering: Re-engineer financials to become attractive to publicly traded and large private equity institutions

2) Operations Engineering: Re-engineer internal process to become optimized, consistent and repeatable

3) Modern Marketing Science: Refocus marketing spend to achieve ROI on every dollar spent

We execute these three core strengths to ensure the company thrives for decades to come in both good times and bad.

Ideal opportunities are:

- 2-10 FTE's

- Located in: Tri-State Area

- Industry Agnostic: Prefer relation to Finance, Real Estate, or Energy industries

- Utilizing recurring revenue business model

- Generating $2MM-$5MM in revenue